The accountability, use and cost of trucks, cranes and roofing equipment are important elements in a roofing contractor's operation. You need to make sure you have accurate information—improperly determining equipment cost rates can negatively affect your bottom line.

The 11th edition of NRCA's Roofing Contractors Equipment Cost Schedule recently was released and lists some of the most common products used in roofing operations. In addition, the publication provides help when determining equipment costs for your roofing business based on depreciation, major repairs, interest, taxes, storage and insurance. Following is an overview.

What it is

NRCA's equipment cost schedule is an electronic document to help roofing contractors make informed decisions when setting roofing equipment cost rates. It includes descriptions of the pieces of equipment as they commonly are sold; their selling prices; and monthly, weekly, daily and hourly expense rates.

The cost rates established for equipment represent an approximate average of conditions under which the equipment is expected to operate.

The equipment costs are based on the average list prices of known suppliers, free on board from their points of manufacture plus 10 percent for freight.

The prices and rates are provided as a guide to be used only when estimating direct costs. The prices and rates do not account for operating and maintenance costs or profit. This means adjustments may be required for particular conditions, such as weather, job locations and length of a construction season.

The costs also do not consider loading, erecting, operating or dismantling equipment; fuel; lubricants; expendable items; wages or transportation of operating crews; or general business expenses. Sales and use taxes also are not included. All these items should be considered when calculating actual costs.

What's new

The following changes have been made to better reflect the costs incurred by roofing contractors when using equipment:

- Costs: The most apparent change is the values of the average costs have been updated to more accurately reflect the current marketplace. This includes increasing the additional cost for freight and setup from 6 percent to 10 percent.

- List updates: New items have been added to stay current with the evolving technology of the industry.

- Insurance percentage: Insurance costs include premiums for policies covering risks to equipment, including fire and theft. They do not include contingency allowances for uninsurable losses. Insurance costs are estimated at 2 percent, an increase from 1 percent.

- Depreciation percentages and average use: The conservative average months per year a roofing contractor can reliably use equipment and the average life of each listed item were evaluated. Changes to the values used in the schedule to arrive at expense per month were made.

How it works

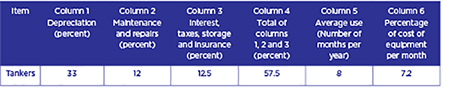

Cost schedules for each item are first determined by figuring the percentage of the equipment cost that should be expensed each month. This is done using "The Schedule to Arrive at Expense per Month Chart" (see Figure 1). This percentage is calculated by combining key factors about each listed item or piece of equipment such as useful life; months in a given year it can be used; and other associated expenses like maintenance, repairs, insurance, taxes and storage.

Figure 1: The Schedule to Arrive at Expense per Month

The expense per month as a percentage of the cost of the product then is multiplied by the average cost to get the expense per month figure in the equipment cost tables. This also is the base number used to derive the per month, week, day and hour values listed alongside the monthly total.

Using tankers as an example, in Figure 1, the useful life is estimated to be three years; therefore, 33 percent annual depreciation is listed in Column 1. The average use in months per year (Column 5) is estimated from industry averages (eight months). Maintenance and repairs are estimated to be 12 percent, and interest, taxes, storage and insurance are estimated to be 12.5 percent. The total percentage of depreciation (Column 1); maintenance and repairs (Column 2); and interest, taxes, storage and insurance (Column 3) is 57.5 (Column 4). When divided by the estimated average use in months per year (eight), the total expense percentage is about 7.2 (Column 6).

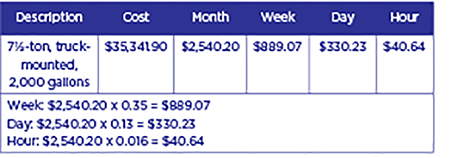

Figure 2: Calculated monthly rate

Therefore, for our tankers example, the monthly rate is 2,540.20 ($35,341.90 x .072) (see Figure 2). The weekly, daily and hourly rates (see Figure 3) are calculated by multiplying the monthly rate by the following percentages, respectively: 0.35, 0.13 and 0.016.

Figure 3: Calculated weekly, daily and hourly rates

Where to get it

The updated electronic version of NRCA's Roofing Contractors Equipment Cost Schedule is available free for NRCA members and can be downloaded at www.nrca.net/store. Nonmembers may purchase the document or download it.