2004 may be the year roofing contractors can relax and re-examine their tight budgets. Seventy-six percent of respondents to NRCA's Quarterly Market Condition Report say they are cautiously optimistic about the economic conditions for the next 12 months (the poll was taken in September). When comparing current conditions with those from 2002, 31 percent of respondents say conditions are slightly better (14 percent report conditions are better; 26 percent think conditions are the same; 16 percent believe conditions are slightly worse; and 13 percent say conditions are worse). The survey was e-mailed to about 4,000 NRCA contractor members registered on NRCA's Web site; 139 people responded.

Despite the U.S. jobless rate reaching its highest level in nine years, the economy is recovering, though slowly. (See "2004 construction outlook," for more information about the economy.)

Roofing contractors told NRCA and Professional Roofing they agree with the positive economic outlook. Contractors report, despite a continued concern about low cash flow, economic problems are being overshadowed by more monstrous issues—such as increased insurance premiums, heightened competition and a work force shortage.

Insurance

Across the United States, contractors are screaming about the insurance crisis.

Kirby Sensenig, president of Richard L. Sensenig Co., Ephrata, Pa., says his top three issues are "rising insurance costs, insurance premiums rising uncontrollably and too many ambulance-chasing lawyers pushing up insurance premiums." He adds, "Do I need to repeat that?"

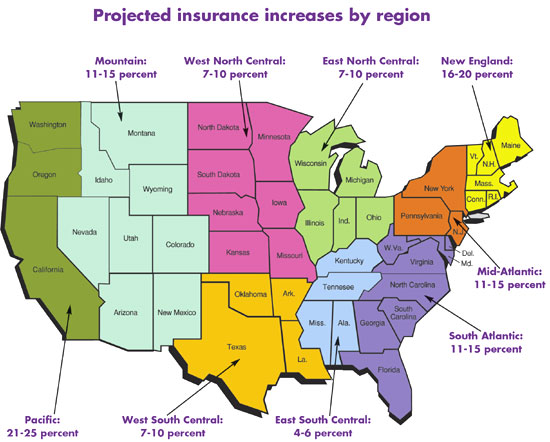

Roofing contractors predict these insurance premium increases for 2004-05.

In Indiana, Chris Underwood, president of Formation Roofing & Sheet Metal Inc., Indianapolis, reports conditions are no different.

He says: "I would have to assume from feedback that Indiana is not the only state that has literally no one in the insurance business wanting absolutely anything to do with a roofing contractor, regardless of claims. Until this notion from insurers changes, I do not have to worry about any other challenges. All my time is dedicated to keeping the insurance company we have satisfied with our company and our policies."

On the West Coast, William Bolt, president of ABC Roofing Co., Clackamas, Ore., states: "Construction-defect claims are out of hand and need to be narrowed to directly involved parties. Our insurance company paid $20,000 on a claim after the independent consultant gave our company a 0 percent responsibility on a hospital project."

Conditions are equally bad in Florida.

"Group health insurance for small- to medium-sized businesses is exorbitantly expensive, and having it affects our competitive position," explains Steve Sutter, president of Sutter Roofing Co. of Florida, Sarasota.

Contractors also discussed their frustration with complying with insurance without price relief.

"The lack of competition among insurance carriers is frustrating. Although I realize we are in a high-risk profession, there are many of us with excellent track records," notes Tom Furey, president of Furey Roofing & Construction Co. Inc., Providence, R.I. "Yet the insurance premiums keep increasing with no relief in sight."

Insured contractors are taking issue with the number of uninsured contractors who are able to secure work.

"When insurance claims are filed by our customers, why do adjusters look for the cheapest price to fix the problem instead of looking at which contractors carry insurance and then select the lowest bidder?" asks Roger Harness, president of Harrison, Ark.-based Harness Roofing Inc. "In our area, adjusters get quotes from guys who work out of the back of their trucks with no insurance."

Other problems

Insurance is not the only concern of professional contractors. Many contractors want to change the unprofessionalism in the roofing industry created by shady contractors.

"Our industry has too many low-ball-mentality contractors; perhaps the insurance increases will weed a few out," says Steve Amend, president of Roofing Services Inc., Santa Rosa, Calif.

Dave Chenoweth, principal of David A. Chenoweth Roofing Inc., Three Rivers, Mich., also feels the toll of new competition.

He states, "Our residential division has been hurt by the almost overwhelming amount of upstart contractors installing shingle roof systems."

Some contractors believe industry leaders, such as NRCA and manufacturers, can help increase professionalism in the roofing industry. Jim Butters, president of Four Hearts LLC d/b/a Advanced Roofing & Gutter Systems, Birmingham, Ala., believes manufacturers should allow only certified roofing contractors to install their products.

Mike Miller, president of Pete Miller Inc., Marion, Ohio, believes licensing of professional roofing contractors should be a priority for industry leaders.

He says, "This year, I lost more jobs to unqualified contractors than I care to count."

The unprofessional practices of some contractors are reaching beyond hurting the industry's image; poor work also affects safety.

Steve Daly, secretary/treasurer of Kaw Roofing & Sheet Metal Inc., Kansas City, Kan., says he has been trying to "maintain my focus on safety versus productivity while watching the competition unsafely redefine the level of margins."

Many contractors believe improving the industry's image and raising the standard of professionalism is their responsibility. Underwood thinks professional contractors should educate customers to make them understand the risks of hiring "backyard contractors."

In addition to educating customers, contractors also have to treat them better.

"Our industry needs to focus on training personnel in the area of customer service," says Chris Jurin, vice president of Jurin Roofing Services Inc., Quakertown, Pa. "By better servicing our customer base, we will improve the customers' perceptions of the industry."

Another problem topping the list of concerns is a lack of qualified workers.

"The labor factor always is a consideration," notes Marv Miller, vice president of Twin City Roofing & Material of Mandan, Mandan, N.D. "The less-populated regions of the country will continue to experience a tight labor market. There just aren't enough bodies to go around."

But even when contractors can find qualified workers, they have a hard time retaining employees.

"We have hired numerous roofing crew personnel who, after being trained, are hired away by other roofing contractors," explains Bill Taylor, CEO and chairman of D.C. Taylor, Cedar Rapids, Iowa. "Our hiring and training expenses are quite high, and besides, this is frustrating."

In Ashland, Va., Nicholle DeShazo Anderson, controller of J. King DeShazo III Inc., says: "We continue to have problems attracting and obtaining roof mechanics and field supervisors. The more work we seem to obtain, the more qualified field personnel we seem to lose."

Expanding regulatory standards also have affected the work force crunch. And homeland security policies and tightened immigration policies hinder contractors' abilities to expand their crews.

"I am concerned about immigration policy and work force issues. Although a weak job market and border security concerns are conspiring to dampen any liberalization of immigration policy, I don't have a flood of displaced high-tech workers eager to begin a new career installing roof systems," reports Todd Hewitt, president of Texas Fifth Wall Roofing Systems Inc., Austin.

Volatile weather didn't help the work force issue either.

Mose Beachy, president of M.E.B. Systems Inc., Sugar Creek, Ohio, says, "With an exceptionally wet year, our cash flow has been tight all year because we could not complete projects in a timely fashion; the weather forced us to have up to four projects in progress with not enough manpower to keep everyone happy."

Weather affected more than work schedules. A post-hail economy in Wisconsin is making it difficult for some contractors to find work; contractors completed so much work after a hailstorm in 1998, roof system replacements are not needed at this time.

Reid Ribble, president of The Ribble Group Inc., Kaukauna, Wis., explains: "Insurance experts state 70 percent of buildings in our market have had new roof systems installed since 1998. Finding roofing work at profitable pricing is the biggest single issue we face."

In addition to discussing issues that are hampering companies' growth, contractors are voicing their concerns about other industry segments.

Clifford Johnson, president of Empire Roofing & Insulation Co., Tulsa, Okla., mentions that he is worried about "the lack of material manufacturer concern for quality and professionalism."

He goes on to say: "My biggest concern is that there has been too much manufacturer consolidation resulting in a lack of competition. I have noted, during the past several years, manufacturers have had less customer service, less concern for their major contractor base, and more concern about sales and profits. This puts all in a bad place."

But Ruben Villarreal, general manager of Commercial Roofing LLC, Albuquerque, N.M., believes, "Distributors' policies about service and stocking levels will lead to more direct sales by manufaturers."

And Dave Ferris, president of Traverse Bay Roofing, Traverse City, Mich., notes: "Architects are failing miserably at creating specifications that make sense. Drawings are increasingly lacking in information to responsibly bid work."

Growth areas

Despite the many concerns and problems, 2003 was a year of growth for some companies. As in past years, repair and maintenance continue to be moneymakers.

"Service was our largest growth area," Jurin states. "The service segment of the industry has little competition but appears to be poised for the largest percentage of growth in the industry."

Although some companies focused on maintaining existing roof systems, the increase in new construction projects helped others.

Amend says: "[The biggest growth area was] high-end custom homes. It is not uncommon for us to bid several $100,000 residential roof systems each month."

Anderson reports the residential roofing market also boomed in Virginia. She saw growth in the metal market, as well, while the low-slope roofing market remained constant.

The commercial steep-slope roofing market, however, increased in New England. Rob Therrien Jr., president of Al Melanson Co. Inc., Keene, N.H., says his company performed more of this work, especially in the religious building market.

Chip Cornell, president of Cornell Roofing & Sheet Metal Co., Independence, Mo., performs commercial and residential work. He reports new construction and sheet-metal work increased. But a dry climate affected the reroofing market. The company, therefore, bid on more new construction projects than typical.

But Marv Miller notes commercial projects are lacking in North Dakota. He says: "Our part of the country seems to have less commercial work available for bid. We have seen some bidding that I would almost classify as ‘panic' bidding. I don't think our company is much different from most competitors in the area, yet we see some contractors bidding jobs at 15 percent to 20 percent below what we think is our break-even point."

An aging population might begin to help some contractors find work. Hewitt says health-care sector construction increased in Texas; he believes it was driven by aging baby boomers.

Not everyone was blessed with growth areas during 2003.

"Growth became a one-word oxymoron this past year," Daly admits. "Sales were down slightly along with [profit] margins. Our greatest inroads, however, were in the historical renovation area."

Material trends

While business sectors grew, new material trends emerged. One trend is using light-colored and environmentally friendly materials.

"I believe materials [for 2004-05] will keep pace with 2003-04 with evolving emphasis on environmental roofing trends," Daly says. "Manufacturers are aware of this in terms of pigment changes in metal roofing and a growing lean toward sustainability."

Hewitt states: "The cool roofing phenomenon has reached critical mass. Better tools to identify and present the benefits of cool roof systems along with increased government incentives have attracted customer interest."

And customers' wants may be pushing the latest trend.

"Owners appear to be moving toward the use of higher-end products," Jurin notes. "There is a significant trend in our local marketplace in the use of white membranes [instead of] black."

The light-colored material trend may help decrease some common hazards in the roofing industry.

Taylor says: "A lightweight, often light-colored material … is easier to install than most roofing materials. This and other materials will continue to take market share away from materials that are heavier and more difficult to install, including the materials that require the use of hot asphalt, which continues to be just as dangerous as ever.

"We had one burn accident in the past four years, which resulted in a $250,000 workers' compensation claim. We cannot work enough man-hours in five years to recover that expense. The economies of roofing dictate that we entirely discontinue using hot asphalt products. Further, products requiring adhesives will continue to fall in market share as self-adhesive products become available and mechanical fastening becomes more widely accepted by the design community."

Metal roofing also grew in popularity. Contractors throughout the country report installing more metal roof systems.

Mark Stori, president of Metal Roofs of Florida Inc., Sebring, says, "We expect an increased usage of light-gauge steel roofing in residential and light commercial steep-slope roof applications."

"In our area, northern California above San Francisco, we see a continuing trend toward metal and single-ply roof systems," Amend adds. "More of the buying public want quality roofing to go along with the increases in property values in our area."

Although Craig Alper, president of Alper Enterprises, Moorestown, N.J., believes metal roofing is where the industry is headed, he, like other contractors, thinks TPO membranes are being used more often.

Alper explains: "TPO products seem to be gaining an ever-increasing share of the market. Self-adhering type materials, modified bitumen and others are making inroads into more and more specifications as architects and building owners attempt to distance themselves from the use of hot bitumen and/or cold coatings and adhesives."

Pete Schmautz, general manager of Star Roofing, Phoenix, says: "In our market, TPO membranes continue to gain market share. Single-plies, in general, continue to do well. Built-up roofing [BUR] is slightly off from last year, and it does not appear BUR will regain market share. Some of this may be because of the increases in crude oil prices. Modified products have remained steady."

Florida contractors also see more TPO membrane use.

"In the Florida market, TPO continues to gain momentum at the expense of EPDM," Sutter adds. "Cold-process roof systems are increasing in popularity. More BUR specifications incorporate cap sheets in lieu of gravel."

However, some contractors note a move away from using TPO membranes. Bolt sees BUR regaining popularity in Oregon. And Billy Batson, general manager of Parker Roofing Inc. d/b/a Carolina Roofing & Guttering Co., Jacksonville, N.C., agrees.

Parker says, "It appears BUR materials and metal roofing are in greater demand this year than the previous year."

A trend many contractors expect regarding materials is increasing prices during 2004.

"I do not look for much relief in pricing. The asphalt situation in pricing and supply is something we always hope we have covered in our bidding," Marv Miller explains. "If we guess high, we could take ourselves out of getting a bid. If we guess low, we dig in our pocket."

Therrien states: "There will be slight increases in material costs and a shortage/allocation of certain materials. Typically, asphalt-based products will be the most affected."

Price increases are expected for more than asphaltic products.

Greg Campbell, vice president of sales and marketing for John J. Campbell Co. Inc., Memphis, Tenn., notes: "[I believe there is] less use of wood fiber—the government is buying all it can, and prices will begin to skyrocket. Perlite already is on allocation and likely will follow in price increases. Polyisocyanurate insulation manufacturers will be the next to increase prices (more than they already have). In general, material prices are edging up, so by this time next year, price may play a larger role in roof system decision making."

Changing times

The past few years have been tough for contractors. Dreadful economic conditions, soaring insurance prices, increased federal regulations and tightened immigration policies have taken their toll on many. But roofing contractors are remaining optimistic.

"Between the weather, economy and insurance crisis in the metropolitan New York area, it is amazing we still are in business," says Douglas Klein, president of H. Klein & Sons Inc., Mineola, N.Y. "We wonder what else can go wrong and feel that if we get through this, we can get through anything."

Kate Gawlik is associate editor of Professional Roofing magazine.

2004 construction outlook

by Carl Good

"The construction industry has proved to be one of the more resilient parts of the economy over the past couple of years," says Robert Murray, vice president of economic affairs for McGraw-Hill Construction Dodge, a division of The McGraw-Hill Cos., New York. Murray presented McGraw-Hill's construction industry forecast Oct. 23 during the organization's Executive Conference in Washington, D.C.

For 2004, Murray projects total construction will edge up 1 percent to $506 billion but says the economic landscape contains several constraints that will affect construction next year.

He says: "The number of payroll jobs fell during seven of the first nine months of 2003, and it remains to be seen how long the ‘jobless recovery' will persist. Firms continue to keep a tight rein on costs, which means the expected pickup in investment and hiring will be gradual, and any pickup in demand for commercial space will also be gradual."

For 2004, Murray says: "It's projected the construction industry in 2004 will once again see an offsetting pattern by a major sector with a somewhat different mix of pluses and minuses than 2003. The pluses will slightly outweigh the minuses, enabling total construction to rise 1 percent."

Once considered one of the more cyclically sensitive parts of the construction industry, single-family housing has shown extraordinary strength during 2001-03, essentially maintaining an upward trend during the past three years.

Single-family housing construction for 2003 will reach 1.36 million units (based on Dodge reports), which represent a 4 percent gain over 2002 and are 15 percent above the 1.184 million units registered in 2000 just before the start of the recession.

However, a strengthening economy likely will mean a modest increase in interest rates in 2004 from the current 30-year fixed rate of 6 percent to 6.5 percent to 7 percent in 2004. With an unemployment rate above 6 percent and continued focus by businesses on controlling costs, slow growth in jobs and incomes are not expected to outweigh the negative effect of higher interest rates. As a result, Murray forecasts a 2 percent drop in dollar volume for single-family housing in 2004, but he points out that at $226 billion, this still represents a healthy amount of activity—the number of dwelling units still would represent the third highest level during the past 25 years.

Public works construction advanced for the fourth straight year in 2002; however, the outlook for public works projects has shifted dramatically. The volume of new construction starts is expected to be down 10 percent in 2003 because of federal deficits and tight state budgets. Murray predicts tight budgets still will be present in 2004 but expects less in the way of funding dislocations coming from the states. As a result, public works construction is expected to edge up 2 percent, a partial rebound from the 2003 decline.

Income properties, which include commercial buildings and multifamily housing, showed the most immediate response to weaker economic conditions during 2001-03—they also are expected to benefit most from the stronger economy in 2004. Murray anticipates hotel and warehouse construction to see double-digit growth while office, store and multifamily housing will continue the upward trend in 2003 and experience a modest upturn. Overall, income properties are projected to climb 9 percent in dollar volume and 5 percent in square feet.

The institutional building market faces a mixed agenda. Demographic pressures continue to support construction because of rising student enrollments and the ongoing population shift to the South and West, and the large volume of bond measures passed in recent years will spur some construction. However, the fiscal position of state governments has deteriorated significantly, and the effect of restraint for institutional building construction likely will continue for a few years. Murray expects institutional building construction to fall 6 percent in 2003 to 525 million square feet, which represents a 1 percent drop in dollar volume and another 1 percent in dollar volume for 2004.

Although manufacturing plant construction has experienced a long, steep decline from 1998-2002, economic indicators for the manufacturing sector are improving. Industrial production increased during the summer, especially in high-tech goods, and factory orders have strengthened. A renewed growth in computer and technology investment is overdue—the demand typically operates in three-year cycles, the last of which occurred in 1999-2000. And because there has been little new construction in recent years, aging plants will need more efficient facilities to stay competitive. Murray projects a 9 percent increase in manufacturing plant construction for 2004. Although this shows improvement over 2003, he is quick to clarify the level of construction will remain more than 60 percent below the peak level from 1997.

Carl Good is publisher of Professional Roofing and NRCA's associate executive director of communications and membership development.