As has been widely publicized, China has been consuming a majority of construction materials during the past few years. The Chinese gross domestic product (GDP) increased 9.1 percent in 2003, reaching its highest point since 1997, which indicates the Chinese economy has entered a new high-growth period. And the country's appetite for construction materials isn't likely to abate soon. Following is an overview of the Chinese economy, as well as a close look at the Chinese waterproofing/roofing market.

Real estate industry

Since the beginning of 2004, the real estate market index has shown a tendency of "starting high and going down in steps." The investment in office and commercial buildings increased faster than in residential buildings during the same period.

Credit and land policies have become important macro-control tools. In 2004, the government has issued six land-management policies and five financial measures, including the first interest rate increase during the past 10 years to help control fast-growing investment.

I predict real estate investment will increase 20 percent for 2004 and fall to 15 percent in 2005. Correspondingly, the average profit of this industry will drop, making competition fiercer.

Construction industry

In 2003, the gross production value of the Chinese construction industry was 2.3 trillion yuan (about $279 billion), up 24.6 percent from 2002. The increased value of the construction industry accounts for 6.9 percent of China's GDP, reaching the highest point since the founding of the People's Republic of China.

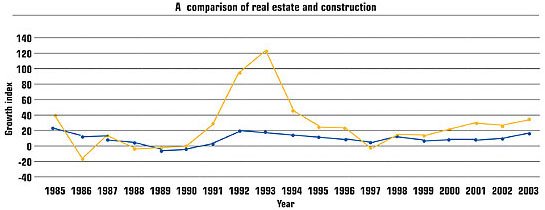

Figure 1 compares the growth of real estate investment with construction industry value from 1985-2003.

Figure 1: This chart shows the contrast of real estate investment growth and production value of the construction industry by percent. The blue line represents the growth of real estate investment; the yellow line represents the construction industry. (Data courtesy of the China Statistics Bureau.)

Fixed-asset investment, especially real estate investment, brings prosperity to the construction industry. But with the macro-control policies being carried out in 2004, the growth of the construction industry is slowing. As a result, the cost of construction is increasing and construction companies' asset-liability ratios still are at high levels averaging more than 70 percent. And their abilities to make profits are weak.

The roofing industry

For the roofing industry, steep-slope roof systems were dominant in China before the 1950s; in the beginning of the '50s, low-slope roof systems were widely installed in large and medium-sized cities in China and then promoted to small towns. Currently, low-slope roof systems account for 80 percent of roofs in large and medium-sized cities and steep-slope roof systems account for 90 percent of roofs in small towns and the countryside. Steep-slope roof system installation will continue to increase in cities, especially for residential buildings.

Coal tar and organic felt were introduced to China as early as the beginning of the 20th century. More polymer sheets, waterproof coatings and sealing materials were used during the '60s and '70s. Since the 1990s, advanced equipment and technologies have been introduced and imported from abroad to allow SBS- and APP-modified bitumen sheets and polymer sheets to develop quickly, challenging the dominant role of organic felt. Now in China, waterproofing/roofing materials are divided into eight major categories, including built-up roofing (BUR) materials.

Roofing materials

Currently, there are about 2,000 waterproofing/roofing material manufacturers in China of which about 600 conform to national industrial policies in terms of production volume and product quality; 70 percent are small companies. Most only manufacture products, but some engage in application. The total number of employees in the roofing materials manufacturing industry is about 300,000.

As the dominant traditional waterproofing material before 1995 in China, oxidized asphalt sheets accounted for more than 90 percent of the total market, including asphalt roofing felts with paper reinforcement, fiberglass reinforcement, glass fabric and aluminum foil with fiberglass reinforcement, etc.

Presently, the material accounts for about 10 percent of the roofing market share.

At the end of the 1980s, modified asphalt sheet manufacturers found it difficult to increase sales extensively in the market because of high prices. That gave way to the emergence of asphalt sheets with composite reinforcements, which use cotton and synthetic fiber as reinforcements and waste rubber as modifier. Such products had a big market share for their low price but now have been listed as products to be used in limited quantities, according to the Chinese government.

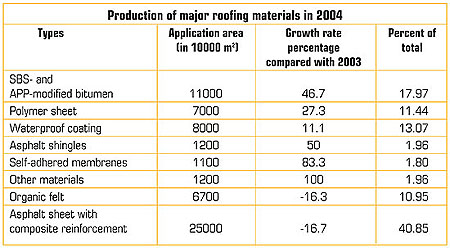

As a new type of material, modified bitumen sheets are the dominant waterproofing/roofing product encouraged by the government in the current Chinese market (see Figure 2).

Figure 2: According to the 2004 Report on the Chinese Waterproofing Industry, these are the market shares of various roofing materials.

The market includes SBS- and APP-modified bitumen sheets, modified bitumen sheets using polyethylene reinforcement and self-adhering rubber sheets.

Polymer sheets are new to China; they include EPDM, PVC, CSPE, CSPE-rubber blends, polyethylene sheet and polyethylene-polypropylene fabric composites. Among them, EPDM and PVC strongly are encouraged by the government.

The tile category in China includes asphalt shingles, concrete tile, compound plastic tiles, metal tile, etc.

With regard to sealants, silicone structural sealants are used for construction, as well as polysulfide sealants, polyurethane building sealants and acrylic building sealants. Spray polyurethane foam (SPF) and metal also are gaining in popularity.

Material forecast

SBS-modified bitumen sales account for 85 percent of the total modified asphalt sheets in the market. APP-modified bitumen mainly is applied in south China and frequently has been used to waterproof overpasses in recent years.

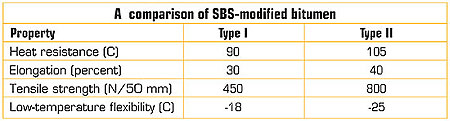

According to the national standard, SBS-modified bitumen is divided into Type I and Type II. Type II accounts for 15 percent of the total SBS-modified bitumen market. Figure 3 compares the major properties of Type I and Type II products.

Figure 3: These are the two types of SBS-modified bitumen materials in China. Type II accounts for 15 percent of all SBS-modified bitumen used in China.

Currently, there is a large number of low-quality and fake SBS-modified bitumen products in the market. Reputable manufacturers are beginning to fight back against these products.

Asphalt shingle production has developed quickly and is the priority choice for the roof conversion projects (changing a low-slope roof into a steep-slope roof) conducted by local governments. Imported asphalt shingles, mainly represented by Owens Corning, Toledo, Ohio, account for 60 percent of the Chinese market. Some other companies from the United States, Canada and Europe also sell shingles in China. Chinese-made asphalt shingles are behind imported materials in terms of technology and quality.

EPDM mainly is produced in China with only a small number of wider products and adhesive tapes and sealant imported. Imported EPDM is more advanced than the Chinese version in terms of bonding technology.

PVC production mainly is domestic with some imported products. Sarnafil, Sarnen, Switzerland, takes the lead in technology. Most Chinese-made PVC sheets are without internal reinforcement but can be reinforced by backing.

There is only one domestic manufacturer of TPO in China with a small amount imported from the United States and Italy.

As one of the newly emerging roofing products in China, metal has been applied recently on industrial buildings, large shopping malls and public facilities such as China Grand Theatre and No. III Airline Station of Beijing Capital Airport.

As one of the emerging roofing products in recent years, fabric roofing has been installed on the major Olympic stadiums such as the main Olympic Stadium and National Swimming Pool and large-sized public facilities such as New Baiyun Airport in Guangzhou, which has gained close attention in the industry.

One- and two-part polyurethane acrylic coatings and polymer cement coatings mainly are used in large cities, and asphalt-based coatings mainly are used in medium- and small-sized cities.

SPF has begun to catch on in China. There are about 10 companies engaged in SPF application with parts of raw materials imported.

Market survey

In August 2004, the China National Waterproof Building Materials Industry Association conducted a sample survey regarding projects under construction in Beijing. The average construction area of all sample projects was 7,464 squares (67180 m²) with many between 1,111 squares and 3,333 squares (10000 m² and 30000 m²).

According to the survey, asphalt sheets account for more than 75 percent of roof system installation, which reflects market demand. The application of SBS-modified bitumen with polyester reinforcement in roofing rose from 52.12 percent in 2002 to 59.11 in 2004, maintaining a predominant lead.

Among those new and government-encouraged materials, more self-adhered sheets, asphalt shingles and one-part polyurethane coatings are used though their market shares still are small. Asphalt shingles have won recognition among users through application in roofing projects in recent years. Asphalt shingle market share has risen from 0.3 percent in 2002 to 2.97 percent in 2004.

With the Chinese market becoming increasingly important to the global economy, multinational companies have sped up their entry into China.

By September 2004, more than 20 well-known roofing and waterproofing manufacturers have set up solely owned companies, joint ventures or offices in China, such as Carlisle SynTec Inc., Carlisle, Pa.; CertainTeed Corp., Valley Forge, Pa.; Elk Premium Building Products Inc., Dallas; GAF Materials Corp., Wayne, N.J.; Icopal, Herlev, Denmark; IKO Manufacturing Inc., Chicago; Johns Manville, Denver; Lafarge, Paris; Onduline, Paris; Owens Corning; PABCO Roofing Products, Tacoma, Wash.; Reichel & Drews Inc., Itasca, Ill.; Saint-Gobain, Paris; Sarnafil; Soprema, Strasbourg, France; Tajima, Kasugai, Japan; Tegola Canadese, Vittorio Veneto, Italy; Vedag GmbH, Frankfurt, Germany; and W.R. Grace & Co., Cambridge, Mass., among others.

In addition, some international companies sell their products and technology in China through agents and distributors.

Owens Corning established its Asia-Pacific headquarters in Hong Kong in 1994, preparing for its operation in mainland China. During the past 10 years, it has set up offices in Guangzhou, Nanjing and Shanghai manufacturing and selling fiberglass products through leasing and joint ventures. In 2004, Owens Corning officially moved its Asia-Pacific headquarters from Hong Kong to Shanghai and prepared to set up its production base for full participation in the Chinese market. It has taken the lead in the asphalt shingle market of China. It began to set up a solely owned shingle plant in Jiangying, its first in China, on Aug. 18, 2004, with an annual capacity of 1.1 million square feet (10 million m²). The plan greatly will influence the Chinese asphalt shingle market.

With the advantage of labor-intensive production, organic felt has been the first Chinese roofing product to be exported. During the past few years, some other products have been exported, such as asphalt shingles, modified bitumen sheets and EPDM. In addition, some waterproofing equipment and raw materials have been sold abroad. Because competition in the domestic market is quite fierce, it will be a wise strategy, as well as the future aim, for Chinese companies to take part in the international market.

The globalization of the waterproofing/roofing industry will optimize the integration of capital, technology, management, service, labor and market, speeding up the process of meeting the international standards. Meanwhile, the stable increasing market demand will bring good return to investors.

The future

According to estimates of the World Bank, China's GDP will reach 12.49 trillion yuan (about $1.5 trillion) in 2004 and 13.36 trillion (about $1.61 trillion) in 2005 with an annual growth rate of 7 percent and the gross value of the construction industry will reach 3.33 trillion yuan (about $402 billion) in 2004 and 4.32 trillion yuan (about $522 billion) in 2005. It also is estimated the gross value of the construction industry will exceed 9 trillion yuan ($1.09 trillion) by 2010 with an annual growth rate of 7 percent and the added value will be more than 1.5 trillion yuan (about $181 billion) with an annual growth rate of 8 percent accounting for 7 percent of GDP.

The urbanization process stimulates the development of the construction industry. Now in China, urbanization is accelerating. According to the Construction Ministry, the urbanization level will improve 0.8 percent to 1 percent per year to 45 percent in 2010 with the urban population reaching 630 million. The increased investment, infrastructure construction and corresponding service management system brought by the process of urbanization will provide opportunities to the development of the construction industry and waterproofing/roofing industry.

After China's entry into the World Trade Organization, foreign investment and advanced technology cannot only directly enlarge market demand but also push domestic construction companies to meet international standards and enable them to compete internationally.

The World Bank estimates China will need up to $270 billion for its infrastructure construction during the next 10 years. Below-grade projects, especially subways and tunnels, are increasing quickly because they require no ground space, relieve traffic and favor the environment.

Residential construction will continue to be a key point for investment during the next 10 years. It is estimated new construction of residential buildings will amount to 71 million square feet to 72 million square feet (640 million m² to 650 million m²) each year reaching up to 88 million square feet (800 million m²) in 2015. The next 50 years will be golden times for the real estate industry.

The 2008 Beijing Olympics will bring enormous business opportunities to the Chinese construction and building materials industry. Thirty-seven stadiums are needed for 28 events—32 in Beijing and five in surrounding areas. Among these 32 stadiums, 19 will be newly built and 13 will be reconstructed based on existing ones. According to Beijing's planning for the Olympics, all the stadiums, as well as the athletes' apartments, will be completed before the end of June 2006.

Because the stadiums occupy a large space, lightweight materials likely will be selected for roofing—the long spans without columns require a roof system to carry less weight. Materials combining the functions of decoration, waterproofing and insulation will be widely applied, such as galvanized steel sheets, aluminum sheets and stainless-steel sheets.

The event not only will provide new opportunities to China and those international companies coming to China but also boost the development of roofing and waterproofing technology in China.

China also has a "green" Olympics as one of its goals for Beijing 2008. As a result, environmentally friendly and recyclable materials most likely will be widely used.

China exhibition

China National Waterproof Building Materials Industry Association has been committed to the globalization of the Chinese roofing and waterproofing market. Each year, it organizes a professional group to attend international roofing and waterproofing conferences and exhibits in Europe and the United States, holds international seminars for waterproofing/roofing technology and co-hosts China International Exhibition for Roofing and Waterproofing Technology with NRCA.

The Third China International Exhibition for Roofing and Waterproofing Technology will be held June 14-17 in Shanghai. It is estimated more than 150 exhibitors from around the world and more than 10,000 professional visitors will attend the event. The related roofing and waterproofing associations and organizations from France, Germany, Japan and the United States have organized delegations to attend the event. The exhibition successfully has established networking between Chinese professionals in this industry and their counterparts abroad. For more information, contact Olicia Hinojosa, NRCA's manager of international relations and contractor management, at (847) 493-7586. n

Dongqing Zhu is executive vice president and secretary general of China National Waterproof Building Materials Industry Association and a member of NRCA's International Relations Committee.