As many NRCA members and roofing professionals know, NRCA revamped a number of its programs during 2004, and the association's market survey was no exception. NRCA condensed its annual market survey to focus on those roofing market areas most important to roofing contractors: squares of installed roof systems; sales of types of roof systems for low- and steep-slope new construction, reroofing, and repair and maintenance work; and overall sales volume trends.

NRCA first attempted to gather data for the survey by asking about 2,000 NRCA member and nonmember roofing contractors in September 2004 to respond to an online survey and compare their experiences from 2003 and 2004. Although NRCA hoped it would receive enough online responses to complete the report, this was not the case.

NRCA then mailed the survey questionnaire to the same group of contractors and received a total of 199 responses for a response rate of 10 percent—enough to provide sufficient information for the report. However, NRCA's market survey is not a statistically valid analysis of the roofing market; it is intended only to provide feedback from contractors about annual trends in sales volume, squares and the types of roof systems installed.

Some details

Respondents' average sales volumes for 2003 averaged $4,645,494 and $5,711,025 for 2004. When asked about whether roofing sales increased or decreased in 2004 from 2003, responding contractors expected an average increase in sales of 12 percent for 2004. Contractors also reported low-slope roofing work represented 72 percent of their annual sales with steep-slope roofing work representing the remaining 28 percent. These percentages held steady for 2003 and 2004.

The breakdown of new construction, reroofing, and repair and maintenance work also was consistent during 2003 and 2004. On average, respondents reported 26 percent of their low-slope roofing work during 2003 included new construction, 61 percent was reroofing, and 13 percent involved repair and maintenance work. 2004 percentages were 25 percent for new construction, 61 percent for reroofing and 12 percent for repair and maintenance. For steep-slope roofing work, new construction made up 33 percent; 56 percent was reroofing; and 11 percent involved repair and maintenance work.

On average, contractors installed more squares during 2004 than 2003. The average increase of squares applied during 2004 vs. 2003 for low-slope roofing was about 3 percent; the average increase of squares applied during the same time period for steep-slope roofing was about 8 percent.

Roof system types

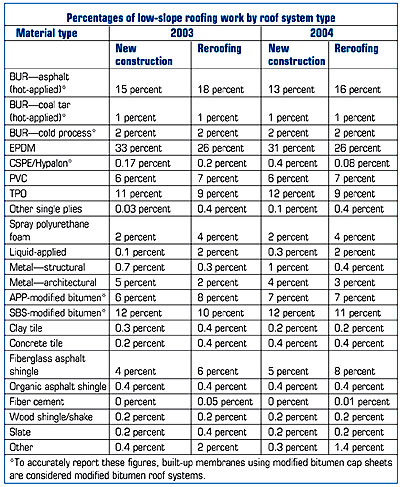

For low-slope roofing work, the survey results show EPDM as the market leader for new construction and reroofing, garnering about a 32 percent share of the new construction and reroofing markets for 2003 and 2004. Modified bitumen roof systems posted nearly an 18 percent share for new construction and reroofing for 2003 and 2004. Following closely were hot-applied built-up roof (BUR) systems, capturing about 14 percent of the new construction market for 2003 and 2004 and 18 percent of the reroofing market for 2003 and 16 percent for 2004. (See Figure 1.)

Figure 1: Low-slope roofing work by roof system type

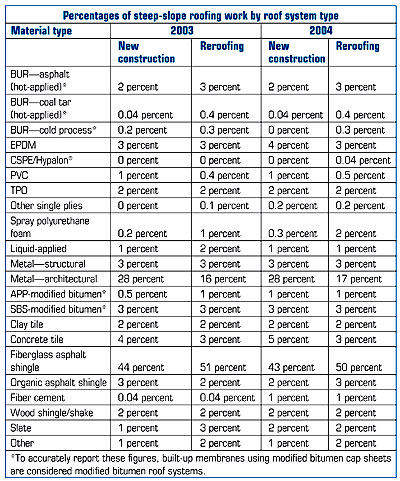

For steep-slope roofing work, fiberglass asphalt shingles led the way with about a 44 percent market share for new construction during 2003 and 2004 and 50 percent share for reroofing for 2003 and 2004. Architectural metal followed with about a 28 percent market share for new construction during 2003 and 2004 and 16 percent share for reroofing for 2003 and 2004. (See Figure 2.)

Figure 2: Steep-slope roofing work by roof system type

This year's survey

This year, NRCA will continue to publish its market survey in a simplified form and hopes to increase the number of participating contractors.

NRCA sent this year's survey questionnaire in March to provide more timely information about contractors' experiences in 2004 and projections for 2005. If NRCA members would like to participate in the 2004-05 NRCA Market Survey, please contact Alison LaValley, NRCA's associate executive director of marketing, at alavalley@nrca.net or (847) 493-7573. By participating, members can receive free copies of the final report.

The final 2003-04 NRCA Market Survey report, which includes data broken out regionally, is available by contacting NRCA InfoExpress at (866) ASK-NRCA (275-6722) or shop.nrca.net.

Carl Good is NRCA's associate executive director of communications and membership development and publisher of Professional Roofing magazine.