The roofing industry always is changing. It ebbs and flows, mostly based on economic conditions. During 2004, the roofing industry continued to struggle as the economy slowly recovered. And though price increases for almost all materials and economic issues still are concerns as roofing contractors prepare for 2005, contractors hope the roofing industry will continue to benefit from an improved economic outlook.

This year, as it does every year, Professional Roofing surveyed roofing contractors and asked them how they view the roofing industry for the upcoming year. Following are their major issues.

Insurance

The insurance crisis once again is at the forefront of the roofing industry.

Ronald Taylor, president of All*Star Roofing Inc., Amity Harbor, N.Y., says: "In New York, we are facing an insurance crisis of immense proportions. If we are able to get insurance from one or two companies still taking the gamble to insure roofing contractors in New York state, it is at a substantial cost with inadequate coverage. We are not a big contractor but a small business, and right now, we are paying approximately $400 per day for liability insurance—five days a week.

"I am concerned that any day we could be put out of business and lose everything we own because of the insurance crisis in New York state," he continues. "We are not covered for some of the basic coverages—not by choice but by necessity."

Jim White, owner of Triple R Restoration, Elizabethtown, Ky., also is facing difficulties with insurance, saying his concerns include affording workers' compensation insurance and general liability insurance.

In Illinois, Dale Showalter, president of Showalter Roofing Services Inc., Naperville, lists workers' compensation insurance, liability insurance and health insurance as major challenges.

He adds: "Torch-applied system work, our main area of expertise, is being penalized by insurance companies."

Edwin W. Carlson III, president of Roofing Systems Inc., Loves Park, Ill., agrees.

He says: "The workers' compensation insurance program in Illinois needs to be overhauled. The system is screwed up. Illinois has raised the rate charged for premiums per $100 of payroll.

"Workers' compensation claims are paid with a blank-check mentality, and roofing contractors are paying the bill with huge premium increases every year to pay for these claims," he continues. "Several insurance companies do not want to quote workers' compensation in Illinois because of the claims being paid out for injuries. One claim easily could absorb a year's premium!"

In short supply

Another significant concern for contractors is labor shortages. Clifford Johnson, president of Empire Roofing & Insulation Co. Inc., Tulsa, Okla., says the root of this problem lies in the education system.

"Where are we going to get tomorrow's roofing workers, those in the field who care about the quality of the jobs they perform?" he asks. "I think teachers and schools mainly are to blame because they have been telling kids for too long they aren't going to amount to anything if they don't have a college degree and a job sitting in front of a computer.

"There are many kids out there who are not really happy with that lifestyle and want to be outside doing manual labor and making something of which they can be proud," Johnson continues. "But for so long, they have been told they will be 'trash' if that is the life they want, and they instead force themselves to sit in front of a computer. We need to bring back into junior high schools and high schools the vocational classes we had when I was in school more than 35 years ago."

However, for many, it is not just a question of finding workers. It is a question of finding qualified workers and maintaining a sufficiently trained work force.

Gene Walden, owner of McCurdy-Walden Inc., Jacksonville, Fla., is looking for "qualified workers and qualified field management, such as superintendents and foremen," and the issue is just as challenging on the West Coast.

For some, finding a legal and experienced work force is an issue. Some East Coast roofing contractors expressed a litany of labor-related problems, such as finding quality employees with driver's licenses; the need to create less restrictive immigrant labor work permits; and the challenge of recruiting personnel.

"A large problem in our region is the recruitment of employees," says Nicholle DeShazo Anderson, controller of J. King DeShazo III Inc., Ashland, Va. "Not only do we have trouble finding qualified personnel, but temporary agencies no longer are able to supply us with temporary labor because of insurance restraints."

More challenges

Among other challenges contractors mentioned, John Miller, chief executive officer of Western Roofing Service, San Francisco, a Tecta America company, lists his top three as "crazy competition, crazy competition, crazy competition," referring to competition with new companies and unprofessional companies.

James Peterson, president of Peterson Roofing Inc., Arlington Heights, Ill., says his issues include "competing against companies that change their names every few years and lowering our prices to compete with disreputable companies."

Johnson agrees, saying one of the challenges he faces is "being able to perform as a professional while most of my competition is satisfied to just be working and not worry about tomorrow's consequences."

Roofing contractors also face problems competing with roofing contractors who don't carry insurance or are not correctly classified. Struggling to compete with unprofessional roofing contractors makes survival a challenge in the roofing industry, especially in a slow market with increased competition from bigger companies, such as Home Depot.®

Illegal competition and competition from out-of-state roofing contractors also were mentioned. Material challenges and the issue of receiving timely materials were identified as problems, as well.

A host of additional concerns was voiced by roofing contractors, such as taxes, illegal workers performing work, unreliable warranties and general contractors who are not paying on time or at all.

Peterson says educating homeowners is important because companies often easily can take advantage of them.

"All roofing contracting companies should have a third party verify their standings with the community so they can't lie to consumers," he says. Walden takes issue with some of the contracts roofing contractors have to sign.

"General contractors' contracts are becoming more and more restrictive and written in favor of general contractors," he explains. "Pretty soon, we will refuse to sign some of these condescending contracts."

"Keeping the right type of work that fits our structure and allows us to maintain our desired profit points is a challenge," says Roger Harness, president of Harness Roofing Inc., Harrison, Ark. "We are trying to market ourselves for value and quality. The hard bid market is not profitable for our structure."

James Giese, president of Jim Giese Commercial Roofing, Dubuque, Iowa, says his challenges are "keeping up with and complying with government regulations, mandates, etc.; union restrictions and harassment from other unions (we are a union shop); and health insurance costs and other overhead costs."

Cost issues appear to be troubling Showalter, as well.

"The state of Illinois is unfriendly to small business," he states. "One example is adding a 1 percent tax to our workers' compensation costs—one of many added expenses. Also, license plate costs have doubled."

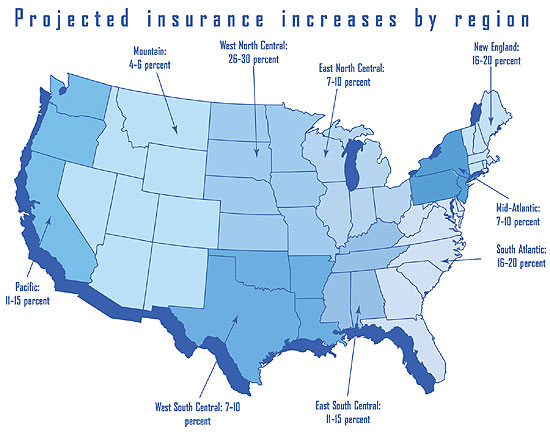

Roofing contractors surveyed by Professional Roofing predict these insurance premium increases for 2005-06. The map reflects the average percentage for each region. (Editor's note: No responses were received from Alaska, Hawaii and Puerto Rico.)

Material trends

More than half the responding roofing contractors say they expect material price increases in 2005.

"Keeping contract prices up to date with material price increases and getting sufficient quantities of roofing materials in a reasonable amount of time" rates as a major challenge, says Joe Chavez, president of Chavez Roofing Corp., Albuquerque, N.M.

Jay A. Rintelmann, president of Hartford South LLC, Orlando, Fla., cites problems with material price control and timely material procurement, especially in the context that Florida roofing contractors are handling emergency roof repairs because of hurricane damage, as well as their usual work loads.

"We are to a point where we are more interested in just getting materials, not solely the price," Rintelmann says. "Projects are being delayed because we cannot man them as needed. Roofing contractors are hit economically on labor and material."

"I think we will see nothing but rising prices," Johnson says. "The polyisocyanurate insulation has started it, and now, others are jumping on the bandwagon.

"The biggest concern I have is that we cannot get pricing beyond an hour from now, yet a lot of our jobs are two or more months out," he continues. "And because of past practices, I don't think we will get owners and general contractors to agree to escalation clauses. If we as professionals hold out for the clauses, the general contractors will shop until they find someone to agree to today's price, hoping against hope prices don't go up that much."

Other roofing contractors mention issues with polyisocyanurate insulation.

Steven Kruger, president of L.E. Schwartz & Son Inc., Macon, Ga., says: "Polyisocyanurate continues to be a price and availability challenge. Alternative insulation products may have to be sought. I also see more change in the formulation of single-ply products."

"There will be price increases for polyisocyanurate, lumber and asphalt," cites Robert McNamara, president of F.J.A. Christiansen Roofing Co. Inc., Milwaukee, a Tecta America company. "About 5 percent to 15 percent more than the current price can be expected, depending on the product."

As escalating oil prices continue to affect the United States, a price increase for petroleum products also has been predicted.

"Insulation and all petroleum-based products steadily will increase during the next 12 months by 10 percent for asphalt-based products and 20 percent or more for insulation," predicts James Stamer, president of Prospect Waterproofing Co., Sterling, Va.

Anderson states, "As petroleum products continue to increase in cost, so will material costs."

Another trend—despite rising prices—is increasing popularity of certain materials.

"I think architectural shingles will stay strong and possibly grow," Taylor says. "I also see simulated slate roofing gaining more of the market. Metal is still going to grow though not as fast as most predict."

Some roofing contractors see problems with material availability.

Jackie Cunningham, owner of Standard Roofing & Sheet Metal, Byram, Miss., says, "Materials will be difficult to acquire; there will be major price changes; and the selection of manufacturers will narrow."

Kevin Halm, who is in charge of operations for Northcross Roofing & Waterproofing Inc., LaGrange, Ill., holds a more optimistic view.

"I expect insulation price increases of 12 percent to 16 percent," he says. "But I do not see a shortage of materials on the market."

Walden sees more of a compromise with regard to price and supply.

"I expect material prices to go up then level off by mid-year," he notes. "I also expect supplies to be tight for awhile then loosen up."

Although some see a move away from torch application and toward TPO, others see a move toward more cold-applied and modified bitumen applications, as well as peel-and-stick modified bitumen and single-plies.

Marv Miller, vice president of Twin City Roofing Inc., Mandan, N.D., isn't sure it is a roofing contractor's place to project future material trends.

"I think it is a question that needs to be answered by the supply community," he notes. "All we contractors can do is parrot what we are being told by everyone."

Gaining business

Roofing contractors also revealed their biggest growth areas during the past year. The answers widely varied though a few popped up more than once.

"Maintenance work provided significant growth," Halm says, and his sentiments were echoed by others.

Commercial roof systems, residential reroofing projects and metal roof systems also topped the list of biggest growth areas.

For some contractors, growth was a result of previous work.

"We picked up several reroofing projects with shopping centers," Miller says. "We received this work because the owners liked our past performances."

Johnson explains why the most growth was seen in reroofing: Reroofing projects went smoothly; customers paid more quickly; and the company didn't have to put up with unreasonable demands from general contractors.

The hurricanes in Florida affected the growth of local roofing contractors. Orlando-based Rintelmann cites hurricane damage and emergency repairs as the biggest areas of growth.

A new year

As can be expected, some old problems have carried over from the previous year, and other problems have sprung up in the roofing industry.

Looking ahead to 2005, Bob Hudecheck, president of Hudecheck Corp., Coatesville, Pa., believes action needs to be taken to improve the market.

"Considering the issues with insulation; the bilateral effect on EPDM products; the fact that insulation will be priced upon shipment; the rising costs of health care, general liability and workers' compensation insurance; and the current employment market, 2005 should be interesting," he says. "We have taken the time to notify our customer base of the effects on the industry and the supply chain, but I think it has fallen on deaf ears. I hope these issues can be resolved so we can move forward."

Krista Reisdorf is associate editor of Professional Roofing magazine.

2005 construction outlook

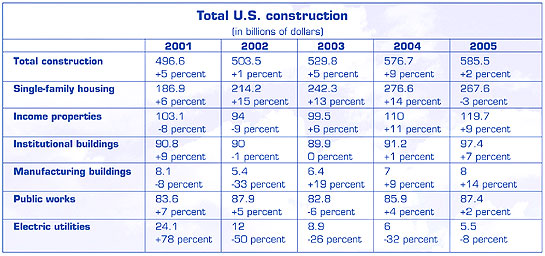

During McGraw-Hill's Executive Conference in Washington, D.C., Oct. 28, Robert Murray, vice president of economic affairs for McGraw-Hill Construction Dodge, a division of The McGraw-Hill Cos., New York, provided his construction industry economic outlook for 2004 and 2005. Overall, indications are the construction market will continue its pattern of sustained growth.

Murray reports the U.S. macroeconomic picture for 2005 will show continued gross domestic product economic expansion to the tune of about 3.5 percent. Although this represents a slight decrease from 2004's 4.3 percent expansion, it will exceed 2003's 3 percent figure. He expects inflation to creep up to about 2 percent to 2.5 percent and anticipates short-term interest rates to rise slowly to offset concerns about inflation rising too quickly. Oil and construction material prices, such as those for lumber and wood products, gypsum, steel and cement, will remain high with not much of a pullback expected for 2005.

Regarding the total construction market, Murray predicts the stable construction cycle of 2004 will continue in 2005.

He says: "In current dollars, total construction continues to see growth while avoiding decline. In constant dollars, the 2004 level is within 1 percent of the 1999 peak. For 2005, there will be a slight decline in single-family housing but more income property and institutional building construction."

And though Murray expects the number of new single-family units to drop 7 percent in 2005, the 1.425 million units this represents is an extremely healthy level.

Murray anticipates income properties to remain solid for 2004 and 2005. Because of the increase of new "superstores," store construction is expected to increase 3 percent in 2004 and pull back by about 3 percent in 2005. Warehouse construction finally is experiencing an upturn, and Murray projects a 5 percent increase in 2004 and 14 percent increase in 2005. Murray also expects hotel construction to improve with new convention center hotel construction, as well as boutique-style hotels becoming increasingly popular. He predicts a 4 percent increase in 2004 and 13 percent increase for 2005 in hotel construction. Office construction was down 52 percent in 2003 when compared with the peak level in 2000. However, because vacancy rates are starting to level off, Murray anticipates office construction to increase 8 percent in 2004 and increase 10 percent in 2005.

Murray reports the multifamily housing market will remain remarkably stable with some pullback in 2005. Murray says institutional building construction largely will depend on whether state and local government budgets finally loosen.

Murray concludes: "Total construction, in terms of dollars, grew 9 percent in 2004 and will grow 2 percent in 2005. But that forecast hinges on the single-family construction market."

Carl Good is publisher of Professional Roofing and NRCA's associate executive director of communications and membership.