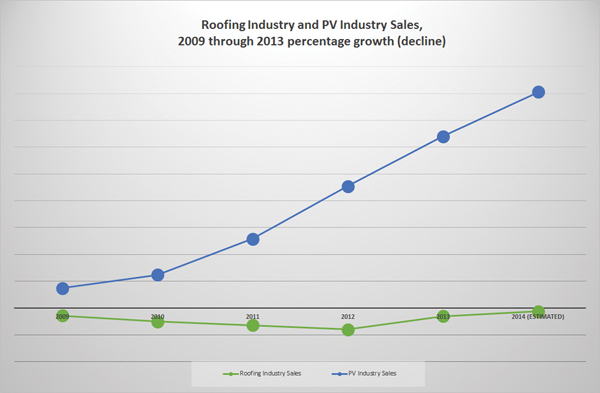

The construction and roofing industries were among the hardest hit business segments during the most recent U.S. economic recession. As reported by respondents to NRCA's annual market surveys, the roofing market declined about 12 percent in sales volume during 2007, another 14 percent in 2009 and hit bottom in 2012 at 40 percent below 2007. NRCA's 2012-13 Market Survey indicates in 2013 the roofing market rebounded to 2009 levels and projects a more robust 9 percent gain this year. Indeed, this is good news for the roofing industry.

However, one construction industry segment grew exponentially during this time period. According to research conducted by GTM Research, a division of Greentech Media Inc., Boston, on behalf of the Solar Energy Industries Association® (SEIA), the photovoltaic (PV) industry grew 37 percent during 2009; 67 percent during 2010; a whopping 109 percent during 2011; and another 76 percent during 2012. By the end of 2013, the U.S. PV market grew another 41 percent in sales volume, and the market projections for this year forecast yet another 26 percent increase. A comparison of sales volumes for the roofing and PV industries during the past five years can be seen in Figure 1.

The rooftop PV business opportunities presented during this growth period went widely unnoticed by the roofing industry. For roofing professionals who become more engaged in the rooftop PV market, there is great opportunity to significantly grow their businesses.

A brief history of PV

The roofing industry's early years are well-documented. NRCA was established in 1886 and roofing industry products, work practices and business models remained stable until the late 1960s and early 1970s when advances in asphalt shingle manufacturing offered numerous, new steep-slope roof system coverings and single-ply and polymer-modified bitumen systems provided revolutionary low-slope system options. Initially, roofing contractors were slow to adopt these new products and systems, but by the end of the 1970s they were mainstream in the marketplace. To help its members better understand a more diverse roofing industry, during the mid- to late 1980s, NRCA began collecting and publishing market data in its annual market surveys.

The 1960s were the early years for the PV industry when relatively new PV technologies were commercially implemented. In 1974, SEIA was organized by five members in a hotel basement. The organization focuses on affecting legislation and policy at the local, state and federal levels to promote the widespread use of solar energy.

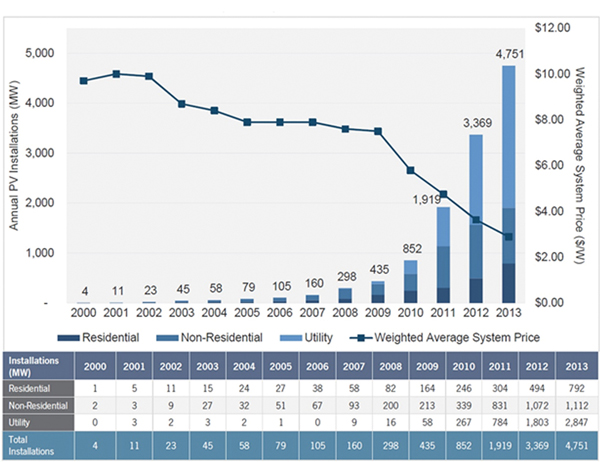

By the late 1990s, new technologies emerged that diversified the products and work practices used to install PV systems. In response to the changing market, in 2000, GTM Research began collecting and publishing data about the PV marketplace. That year, the PV marketplace installed 3.7 megawatts (MW) of solar power. In 2013, the PV marketplace installed 4,751 MW of solar power, an increase of 1,284 percent during 13 years.

Considering this data, the PV industry now considers solar energy to be mainstream in many areas of the U.S., and using solar energy has indeed become more common in the economy and public conversations. According to GTM's U.S. Solar Market Insight Report: 2013 Year in Review: "The U.S. solar market showed the first real glimpse of its path toward mainstream status in 2013. The combination of rapid customer adoption, grassroots support for solar, improved financing terms and public market successes indicate clear gains for solar in the eyes of both the general population and the investment community."

Beginning to merge

As PV technologies have improved, the roofing and PV industries have moved closer together. Roof-mounted PV systems and roof systems now are recognized by the International Code Council® (ICC). ICC recognized this advent in its International Building Code,® 2012 Edition (IBC 2012) Chapter 15—Roof Assemblies and Rooftop Structures. Previous IBC editions were silent regarding roof-mounted PV components; IBC 2012 is the first edition to address roof-mounted PV components in I-codes.

Around 2003, NRCA's Technical Services Section began receiving telephone calls from building owners and roof system manufacturers expressing concerns about PV systems being installed on rooftops, and solar installers were inquiring about best practices for installing rooftop PV systems. In response to these questions, issues and concerns, NRCA established its first PV task force composed of manufacturers, contractors and PV system installers to develop recommendations and industry actions. NRCA's leadership recognized a need for industry information and education about rooftop PV systems and future opportunities in the PV market.

Following its PV task force recommendations, NRCA commissioned staff to develop technical guidelines for rooftop PV installations; a building owner's guide to rooftop PV systems; new educational programs and webinars addressing PV systems and the business of rooftop PV; separate membership categories for rooftop PV manufacturers and service providers; and, in collaboration with the Center for Environmental Innovation in Roofing, established a new organization—Roof Integrated Solar Energy™ Inc. (RISE™)—to develop and deploy a rooftop PV installer certification program in the U.S. marketplace. After two years of development, the Certified Solar Roofing Professional™ (CSRP™) certification was launched, targeting individuals who oversee the installation of PV systems on rooftops.

NRCA took a proactive position in the solar industry by exhibiting and presenting educational sessions at major PV industry conferences and exhibitions. Initially, conference attendees questioned why the roofing industry was there, but by 2010, attendees lined up at NRCA's booth, seeking help to better understand their roofing issues.

NRCA and RISE staff also began serving on various SEIA committees to help ensure the roofing industry's voice was well-represented. Although the two organizations don't always agree, both strive to improve the business of rooftop PV systems. NRCA and RISE are widely recognized and highly respected by the solar industry as resources for roofing technology, workforce and rooftop safety information and for their professional contractor members and certified individuals who embrace the rooftop PV business.

The business of rooftop PV

New federal, state and local policies, legislation and regulations combined with increasing costs of energy, decreasing costs of PV installations, and advances in system efficiencies and product varieties are driving PV systems toward mainstream acceptance—and affordability—in the U.S. marketplace. GTM Research tracks market data in three industry segments: residential, nonresidential and utility. According to GTM Research, during 2013, PV system prices decreased 9 percent in the residential market, 16 percent in the nonresidential market and 14 percent in the utility market.

Overall, from 2012 to 2013, the average annual cost of installed PV systems decreased 15 percent and reached an historic low of $2.89 per watt. GTM Research also reports from 2012 to 2013, residential PV system prices decreased 8.8 percent from $5.03 per watt to $4.59 per watt. And nonresidential PV system prices decreased an impressive 16.3 percent from $4.26 per watt to $3.57 per watt, including prices that ranged as low as $1.94 per watt. Utility system prices also decreased from $2.27 per watt in 2012 to $2.04 in 2013, settling at $1.96 per watt during the fourth quarter of 2013. Figure 2 demonstrates the PV market growth by segment contrasted with declining prices from 2000 to the end of 2013.

Figure 1: Sales volumes of roofing and PV industries during the past five years

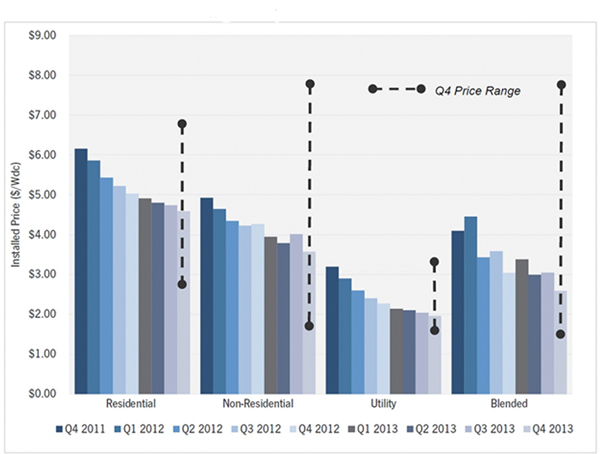

PV installation prices vary greatly not only state to state, but also project to project. Residential system prices range from less than $3 per watt to less than $7 per watt. Nonresidential prices hit levels as low as $1.70 per watt, but prices in some states also range upward to about $8 per watt. Utility prices likewise display high variability. For example, a 50-MW system using a fixed-tilt installation significantly will be less expensive per watt than a 1-MW pilot project that employs dual-axis tracking. Figure 3 shows pricing variance by market segment and by quarter from 2011 through 2013.

The idea "everybody needs a roof" is becoming mainstream in the U.S., and roofing industry professionals know how to meet this need. Typically, roof systems are measured, calculated and priced on a per-square-foot basis. Roofing professionals also know how to design, sell and install other integrated roof system components such as gutters, copings, counterflashings and/or skylights. These traditional integrated components usually are measured, calculated and priced using a different means, such as cost per lineal foot. Roofing professionals are accustomed to designing and selling these components as a typical part of their business.

Figure courtesy of GTM Research, Boston.

Figure 2: Weighted average PV system price and market growth by segment

It is important to realize all types of PV systems typically are measured, calculated and priced on a per watt basis—how much power they can produce. Therefore, cost per watt becomes the cost basis for any given integrated rooftop PV system. Calculating the cost per watt for a particular rooftop PV system is not a difficult calculation. However, arriving at a realistic and accurate projection of actual power production (watts) for a given rooftop PV system requires knowledge of several variables that feed into the calculation, of which roofing professionals traditionally are not familiar. These variables may include PV cell efficiency; actual available solar irradiance at a given site; rooftop shading throughout the year; a building's latitude and longitude; available rooftop space conducive to PV production; building orientation; ambient temperatures; and the level of difficulty to integrate the PV system into a building's electrical system, to name a few. A lack of understanding of these variables has been the primary obstacle to roofing professionals adopting rooftop PV as a customary, mainstream part of their businesses.

Solar installers

The term solar installer is widely misunderstood and often abused. To understand how rooftop solar is installed, we need to clarify the specialized roles solar installers may play in the overall work process.

For example, an individual may claim to be a solar installer if he or she owns or works for a solar finance company or contracting firm. It also is common to find a person who performs rooftop PV system design services, including the electrical system, structural or mechanical engineering, who claims to be a solar installer. Or someone who sells rooftop PV systems and calculates a system's return on investment (ROI) may claim to be a solar installer. A professional electrician also may claim to be a solar installer. And, of course, a person who actually is on a rooftop bolting together a racking system and PV panels also claims to be a solar installer.

There are no solar installer classifications established by the Department of Labor, and the North American Industry Classification System established by the Census Bureau does not specifically define the job of a solar installer. These classification systems are standardized in the U.S. to help discern applicable labor laws found in the Federal Register and assist the insurance industry with assessing risk exposures, especially relating to workers' compensation insurance rates.

In certain local and state jurisdictions, solar installers are identified through contractor licensing regulations. The Database of State Incentives for Renewables & Efficiency maintains a list of ever-changing renewable energy licensing requirements listed by state, but these licensing requirements often do not accurately represent the highly specialized skills needed for successful rooftop PV installations.

For example, the California State Licensing Board requires one of the following contractor licenses to perform solar work:

- A license: General engineering

- B license: General building

- C-10 license: Electrical

- C-20 license: Warm-air, HVAC systems that use solar energy

These licenses do not have requirements for technical roofing knowledge or training, and California's C-39 roofing contractor license does not make any references to PV knowledge or training requirements, yet many roofing contractors in that state are fully engaged in rooftop PV installations. Licensure does not equate with competency in rooftop PV installations.

The North American Board of Certified Energy Practitioners (NABCEP™) certifies individual solar installers. NABCEP was borne out of the electrical industry and its job task analysis helps define the work of PV installers. NABCEP's Executive Director Richard Lawrence has been involved with solar industry workforce development, education, training and renewable energy curriculum development since 2002. When discussing the PV marketplace and its various segments, Lawrence says roofs make the most feasible platform for a PV installation.

"A vast majority of solar installation projects—upwards of 90 percent—are occurring on residential rooftops," Lawrence says. "Close to 10 percent of projects are commercial installations, and my guess is most of these also are occurring on roofs, maybe 70 percent. Rooftop installations are the most feasible. Land is valuable and when PV is installed on or in close proximity to a building, you eliminate the need for long conduit runs, extensive trenching or getting under roadways. Roofs make a lot more sense for the economics, and economics really drive these [design] decisions almost all of the time."

According to Lawrence, electricians may want to handle the electrical part of PV installations, but they are not keen about working on a roof.

"Some electricians believe nobody else should be touching anything having to do with electricity," Lawrence says. "But I've found most electricians want nothing to do with working on a roof. I once polled a training class I was teaching filled with about 80 electricians, asking them how many wanted to climb and work on a roof. Only two of the 80 raised their hands. I then asked how many of them wanted to poke a hole through a roof [to mount a PV system], and not one hand was raised."

When describing the various roles of PV installers, Lawrence says it takes a wealth of knowledge to install a PV system.

"There is a lot of specialization in PV installations, even the sales process," Lawrence says. "It is a multi-staged process beginning with answering the telephone, conducting site assessments, doing preliminary designs, calculating ROI and specializing in customer interface. And it's the same with the work crews, including the electrical and mechanical designs, foremen and supervisors, roof and ground crew personnel and the electrical crew. The electrical work needs to be at least supervised by a qualified or licensed electrician, depending on the jurisdiction. And the commissioning of the system is another specialized skill, including technicians who work with the commissioners for quality assurance checks."

Twelve years ago, NABCEP tried defining the job of solar installer as one person, but the need for a specialized team of individuals with specific skills has led the organization to redefine and rename their certification to its current name—Solar Installation Professional.

Another individual with a deep understanding of solar installation is Joe Sarubbi, project manager for the Interstate Renewable Energy Council (IREC). IREC administrates the Solar Instructor Training Network (SITN), a national training initiative that promotes solar workforce development and is partially supported by the Department of Energy. Sarubbi is an electrician by trade and has spent most of his career as a community college professor and department chairperson.

"My goal [as a professor] is to train students in a way that when they graduate, they could pursue PV installation as part of their careers," Sarubbi says.

Sarubbi helped New York develop a statewide certification program for PV installers. He continues to be a positive influence, developing professional solar installers nationwide in all disciplines. Sarubbi expresses his concerns about rooftop PV penetrations to students in the SITN network by encouraging them to "have the right process in place to ensure roofs do not leak, prematurely fail or lose their warranty protections."

Figure courtesy of GTM Research, Boston.

Figure 3: Average installed price by market segment

Sarubbi views roofing professionals as: " … playing a more consultative role in residential installations, especially to racking system manufacturers to educate them about proper flashing of roof system penetrations. In the earlier years of PV, a lot of general contractors and engineering firms were learning about the commercial PV installation process from electricians and roofing contractors. And the roofing industry should be playing a larger role in these larger kilowatt and MW projects. The solar industry needs installers with stronger roofing backgrounds for these systems. The fact that we [solar and roofing industries] are talking and spending more time communicating, the better it is for the entire PV industry."

Many roofing professionals have made the business decision to fully engage rooftop PV and the growth opportunities it presents. Aaron Nitzkin, owner and CEO of Solar Roof Dynamics, Davis, Calif., is working hard to bring the solar business into the roofing industry. In May 2013, Nitzkin launched his technical distribution company that focuses on helping roofing contractors incorporate solar into their businesses. During a roofing market decline, he saw his solar business grow exponentially and believes there is great potential for roofing contractors to see the same growth in their businesses.

"A roofing contractor is in the best-positioned trade to handle rooftop solar," Nitzkin says. "Roofing always has been done by local contractors and so should solar. Change always is uncomfortable, but being left behind is worse. Rooftop solar is the biggest wealth-producing opportunity of my lifetime. We still are in the early stages [of rooftop solar] with only a 3 percent market penetration today. The potential growth is great. For roofing contractors who are able to effectively add solar to their list of roofing upgrade options, they can potentially see their overall revenue double within two to three years."

Despite the opportunity, Nitzkin says some roofing contractors seem more reluctant than others to make the jump into solar.

"More roofing contractors need to break away from the traditional roofing market and envision the future of the roofing industry," Nitzkin says. "I predict within 10 years, roofing contractors will have the potential to be the dominant trade handling rooftop PV installations rather than solar installers, thereby becoming a stronger household name in their local markets."

The value of a CSRP

John Patterson, CSRP, vice president of Red Pointe Roofing LP, Orange, Calif., has been a roofing contractor his entire career. In 2011, Patterson achieved his CSRP credential and says his company now is positioned as a roofing contracting company with PV expertise.

"We are successfully differentiating ourselves over our competition and have found building owners want roofing contractors to install their PV systems on their roofs," Patterson says. "Typical bid scenarios have the roofing scope of work being sent to roofers, and the PV scope being sent to integrators. This is where we shine [in the marketplace]. We also prefer being paid directly and upfront from a building owner versus the long and drawn out payment process of most third-party solar integrators."

Patterson believes the best opportunity for PV projects comes from performing maintenance work.

"More than 75 percent of our PV work is produced by redoing work done by previous PV installers who had no idea what they were doing on a roof," he says. "It is mind-boggling how many commercial PV projects are being done without coordination with roofing contractors. Building owners who really look at the numbers recognize the value and need for equivalent service lives from their roof and PV systems. As a CSRP, we can most accurately predict and prescribe this outcome, and building owners love that about us."

Embrace PV

There are tremendous growth opportunities for roofing professionals who make the choice to embrace rooftop PV. It no longer is a question of whether you will find yourself involved with a rooftop PV project; it is just a matter of when. The PV industry needs more roofing professionals with expertise in rooftop PV installations to advance the widespread adoption of these systems, build trust, and make roofing and solar synonymous in the public's mind. Roofing professionals can choose a proactive approach to this inevitable and permanent change in the industry by pursuing the CSRP certification and informing customers about the designation.

John Schehl, CAE, RRC, is executive director of RISE.

The PV industry now considers solar energy to be mainstream in many areas of the U.S. In 2013, the PV marketplace installed 4,751 MW of solar power, an increase of 1,284 percent during 13 years.

For more information about Roof Integrated Solar Energy™ (RISE™) Inc.'s Certified Solar Roofing Professional™ certification program, contact Brad Martz, RISE's program administrator, at (847) 493-7574. A free study guide and other resources also are available on RISE's website, www.riseprofessional.org.