An aging population of workers, scarcity of skilled workers, and rapidly changing technological and regulatory landscapes have created many challenges for the roofing industry. And the industry has been ill-equipped to fully understand the magnitude of the challenges because of a lack of comprehensive workforce data and a detailed examination.

To help fill this information gap, the Roofing Alliance commissioned Arizona State University, Tempe, in 2019 to study current roofing workforce demographics, types of work, skilled and unskilled labor shortages, and effects of labor shortages at national and regional scales, as well as industry challenges and potential solutions. A comprehensive survey methodology was adopted to collect data from roofing contractors located throughout the U.S.

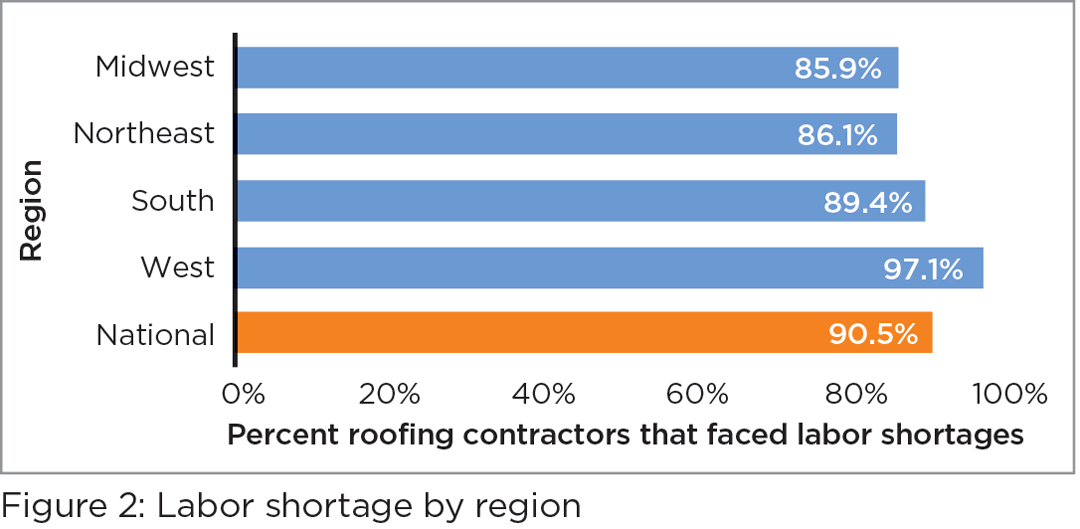

Put bluntly, the labor shortage in the roofing industry is more severe than previously recognized. The study showed 90% of U.S. roofing contractors faced labor shortages during the past year with the West being the region most severely affected by a lack of skilled workers. The roofing industry has adopted many mechanisms to overcome the challenges of skilled labor shortages such as wage adjustments, enhanced benefits, policy reforms and training. Our findings suggest workforce challenges require strategic organizational adaption tailored to specific roofing markets.

Goals

The study was meant to thoroughly examine the demographics of the U.S. roofing workforce, including contracting, manufacturing, distribution and design communities, and types of operations. In addition, the study sought to understand current industry challenges, trends and emerging issues.

The study’s four goals were to:

- Capture a detailed description of the roofing industry workforce, its stakeholders and the work they do

- Gather employment and demographic information about the roofing workforce, including an understanding of its challenges, trends and emerging issues

- Strengthen NRCA’s voice and role in Washington, D.C., by gathering important statistical data that can be shared with regulatory and federal agencies

- Help NRCA serve as a member and industry resource by supplying key statistical data

Methodology

The Roofing Alliance’s steering committee asked us to build a predictive statistical model to determine the U.S. roofing contractor population. The number of roofing contractors in the states that require licensing was used as the response with a number of state-related predictors such as population, building area, land area, annual average rainfall and temperature, etc. The model predicted the relationship between Census Bureau data and state licensing data with other predictor variables. This model was used to predict the number of roofing contractors for other states, resulting in a national population. We predict the U.S. roofing contractor population is about 50,650 ± 5%, which is much more than the existing Census Bureau population estimate of less than 20,000.

Four surveys (company survey, owner survey, designer/manufacturer/distributor survey and employee survey) were devised using a group of roofing experts and were piloted using a subsample of 20 roofing contracting firm owners to critically review the survey for design and structure. Once the recommendations were incorporated, the survey was ready for mass distribution. More than 2,500 surveys were given to roofing contracting firms, designers, manufacturers and distributors throughout the U.S. Follow-up communications were required to raise the response rate and geographical statistical representations from certain states.

The surveys primarily included questions aimed at obtaining demographic information about the roofing workforce, challenges and emerging issues. The primary roofing contractor, manufacturer, distributor and designer surveys contained questions related to company and owner information, employee demographics, labor shortages experienced, effects of labor shortages, perceived magnitude of skilled versus unskilled labor shortages, predicted future industry growth, future challenges, trends and solutions. Companies also were asked to send a separate survey to their employees that contained more detailed questions about demographics, education, experience and satisfaction, as well as their personal perspectives of labor shortages, challenges, trends and solutions. The employee survey was available in English and Spanish, as well as in electronic and hard copy formats. Data was analyzed at the national, regional and divisional subregional scales.

At the end of the surveying period, the response rate was about 20%. This was significantly beyond the targeted sample size for statistical validity. Similar surveys also were sent to manufacturers, distributors and designers to learn more about the current state of their industry sectors and further validate data from the main survey. A statistically sufficient number of responses were received from every state except for Rhode Island and the District of Columbia.

Workforce projections

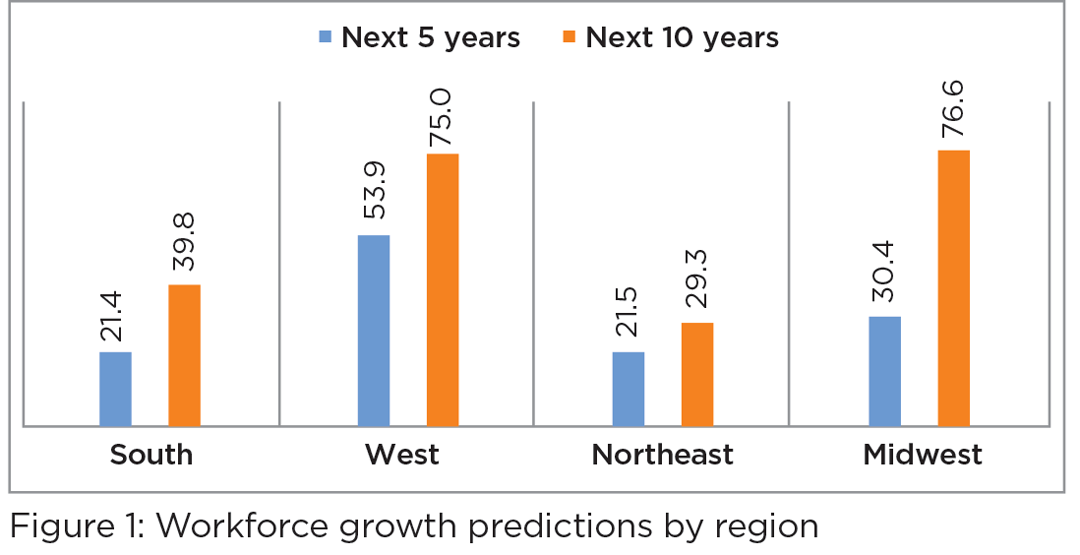

Survey participants predicted the percent increase or decrease in their current workforces for the next five and 10 years. At the national scale, 75.1% of respondents predict their current workforce will grow during the next five and 10 years. When averaged, the predicted magnitude of growth for the next five and 10 years are 24.6% and 41.1%, respectively. The workforce growth predictions at the regional scale are depicted in Figure 1. Among the regions, the West has the highest predicted growth for the next 5 and 10 years along with the Midwest, which indicated a high predicted growth for the next 10 years.

The labor shortage

Among responding roofing contractors, 90.5% have experienced labor shortages during the past 12 months (see Figure 2). The West experienced the highest level of labor shortages relative to other regions with 97.1% of roofing contractors having experienced labor shortages during the past 12 months. In the design community, 82% faced labor shortages during the past 12 months.

Respondents were asked about their agreement with the following statements: “There is a shortage of skilled labor in the roofing industry” versus “There is a shortage of inexperienced labor in the roofing industry.”

Across all levels of agreement, the skilled labor shortage was more severe: 97.1% of respondents agree there is a shortage of skilled labor and 79.2% agree there is a shortage of inexperienced labor. The overall labor shortages for skilled workers are greater relative to unskilled workers. All regions indicated a greater shortage in skilled labor relative to unskilled labor with no relationship with the region.

Overall, the most prevalent effect of a diminishing labor pool reported by the industry was an increase in project cost (89% of respondents have increased their costs as a result of a labor shortage).

Another primary response of a labor shortage on a project was the need to subcontract work. We divided “work” into three types: roofing, sheet metal and other (deck work, tear-off, waste management). Of those three categories, roofing work is the category that most respondents give to subcontractors at 27% of all roofing work being subcontracted.

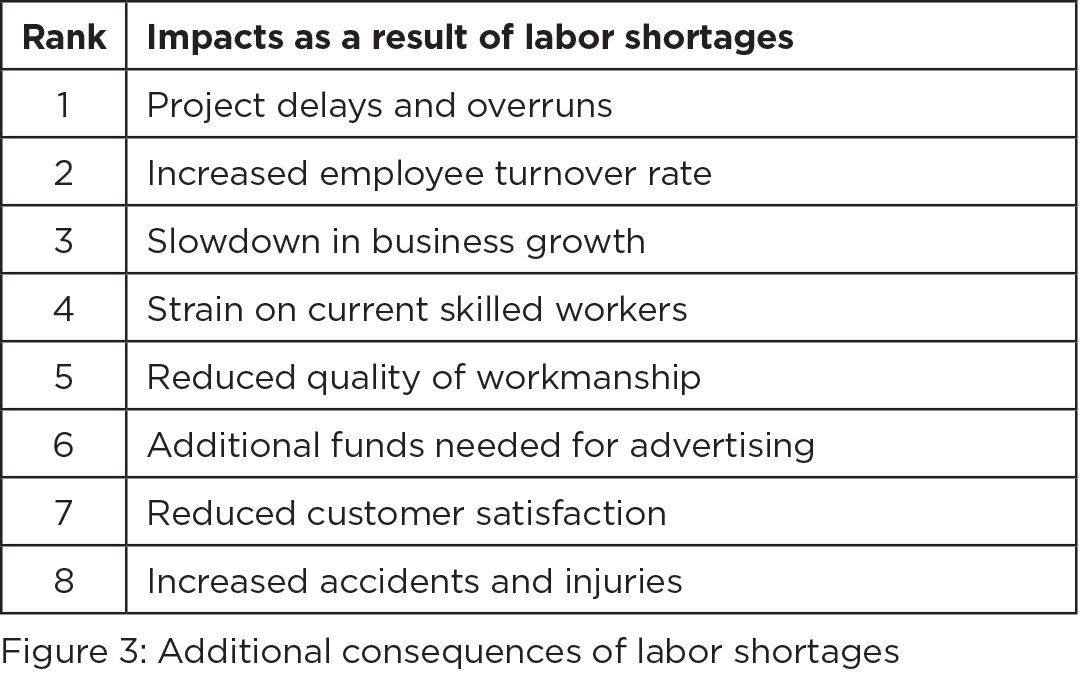

Roofing contractors who responded to the survey also identified additional consequences of the labor shortage. Figure 3 lists them by category and rank based on frequency.

Other challenges

Apart from a lack of skilled labor, roofing contractors surveyed identified an array of other potential threats and challenges facing the roofing industry, including:

- Drug addiction

- Accidents and injuries

- Erratic weather patterns

- An aging workforce

- A broken immigration system

- Lack of adequate training

- Noncompetitive pay scale

- Lack of interest from younger generations

- Difficulties with adopting technology

- Increased litigation as a result of government regulations

- Unethical business practices

Ways to attract workers

In the survey, we asked roofing contractors, manufacturers, distributors and designers to propose potential ways to attract and retain a skilled workforce. For contractors and designers, better compensation was ranked as the best means to attract skilled workers. For manufacturers and distributors, the industry’s image mattered more. Use of effective means to attract a new generation of skilled roofing workers include implementing positive immigration reforms, training and certification programs, and the overall improvement of the industry’s image remain equal in terms of implementation priority.

Demographics

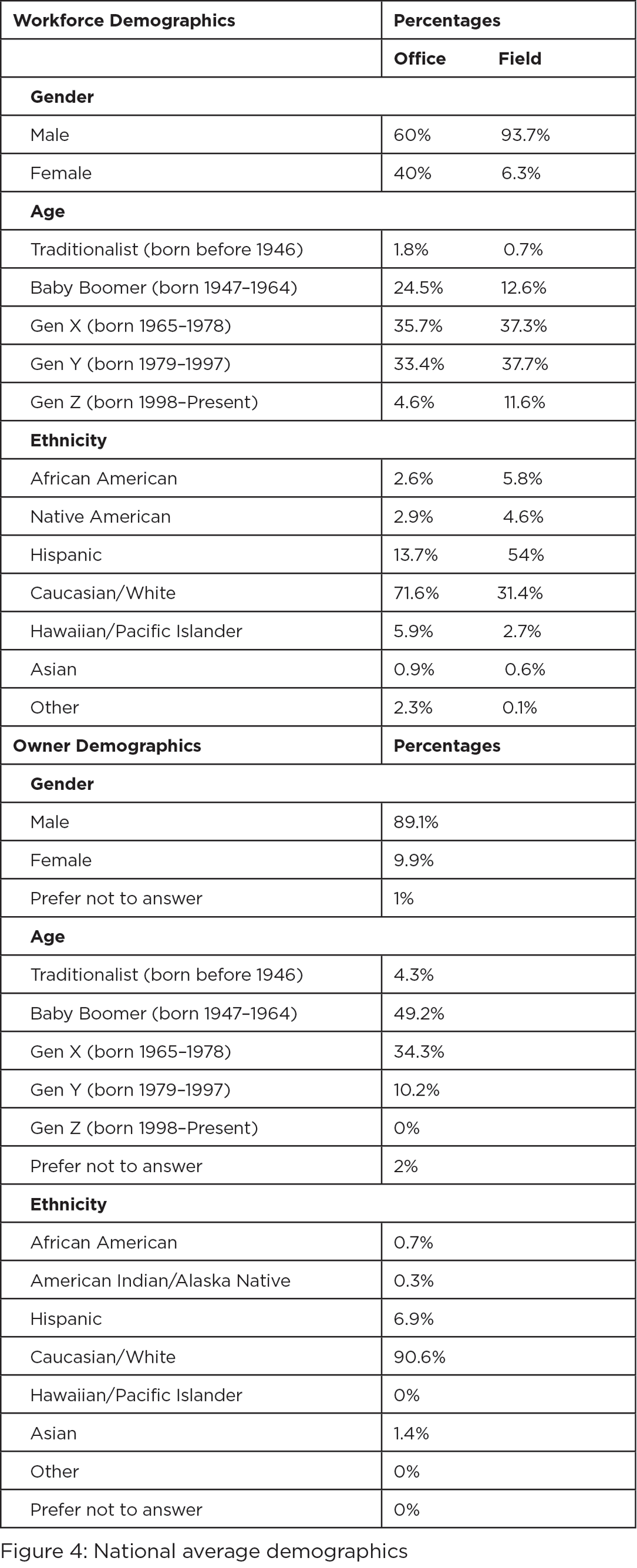

Examining employee demographics for roofing contractors can help determine current and projected industry issues and opportunities. Figure 4 is an account of the national average demographics for roofing contracting firm owners, field workers and office workers. The field workforce is about 6% female. In terms of age, nearly 50% of field employees and 62% of office employees are over age 40. In terms of ethnicity, more than 50% of the reported field workers are Hispanic. Understanding the implications of these trends and devising appropriate plans would strengthen the industry in the years to come. This potentially includes creating better work environments, finding a formula to attract young workers, introducing effective immigration policy instruments, and integrating marginalized racial minorities and women into the industry.

Work ahead

Our study revealed the labor shortage in the roofing industry is far greater than previously projected. Moreover, the magnitude of roofing labor shortages and the nature of the effects differ regionally. Therefore, a comprehensive understanding of the overall industry and region-specific challenges are important to devise appropriate future solutions.

Hasini Delvinne is a graduate student in civil, environmental and sustainable engineering at Arizona State University, Tempe. Kenneth T. Sullivan, Ph.D., is a professor at Arizona State University in the Ira A. Fulton Schools of Engineering and the School of Sustainable Engineering and the Built Environment.